BTC Price Prediction: $131K Breakout Likely as Institutional Demand Grows (2025-2040 Forecasts)

#BTC

- Technical Strength: BTC trades above key MA with Bollinger Band expansion signaling volatility

- Institutional Catalysts: Corporate treasuries and bank partnerships accelerate mainstream adoption

- Macro Outlook: Scarcity mechanics and halving cycles underpin multi-decade bull case

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Bullish Momentum

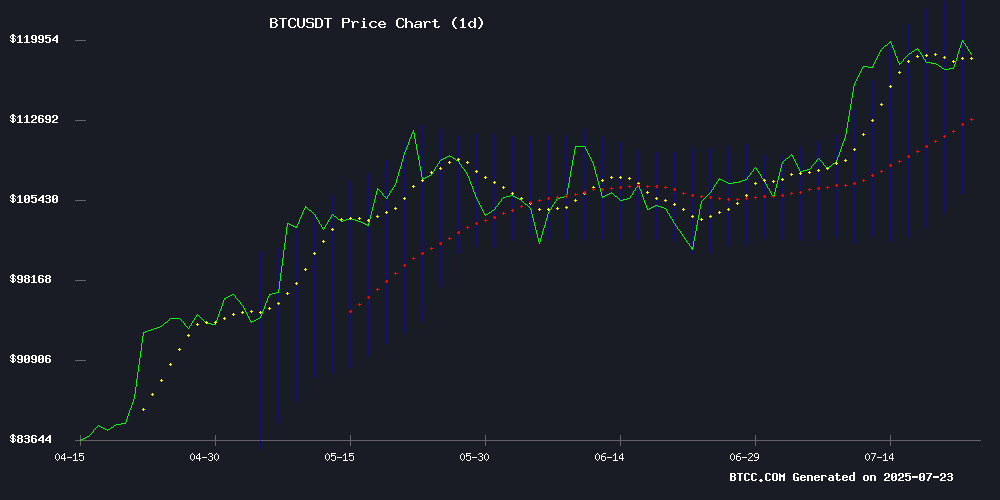

According to BTCC financial analyst William, Bitcoin (BTC) is currently trading at 118,413.85 USDT, above its 20-day moving average (MA) of 115,401.81, signaling bullish momentum. The MACD indicator shows a slight bearish crossover but remains close to the zero line, suggesting potential consolidation before another upward move. Bollinger Bands indicate volatility, with the price near the upper band (124,092.20), hinting at overbought conditions. William notes that holding above the middle band (115,401.81) could pave the way for a test of $131K resistance.

Market Sentiment: Institutional Adoption and Macro Factors Fuel BTC Optimism

BTCC analyst William highlights growing institutional interest, citing Japan's Kitabo adopting bitcoin as a treasury asset and ASX-listed DigitalX expanding its BTC holdings. SpaceX's $153M Bitcoin move and PNC Bank's partnership with Coinbase further validate crypto's mainstream acceptance. However, environmental debates and short-term price battles at $120K may cause volatility. William believes these developments reinforce long-term bullish sentiment, aligning with technical indicators.

Factors Influencing BTC’s Price

Japan's Kitabo Adopts Bitcoin as Treasury Asset Amid Financial Strain

Kitabo Co., a century-old Japanese textile manufacturer listed on the Tokyo Stock Exchange, has announced plans to allocate ¥800 million ($5.4 million) to Bitcoin purchases. The firm will employ a dollar-cost averaging strategy beginning this month, marking its formal entry into cryptocurrency and real-world asset operations.

The move reflects a broader trend among Asian corporations leveraging Bitcoin as a hedge against currency debasement and a foundation for global business. Kitabo joins firms like Metaplanet in treating Bitcoin as a reserve asset, with potential plans to lend holdings for yield generation.

Years of financial underperformance and constrained cash flows drove the decision. The textile company's pivot underscores growing institutional recognition of Bitcoin's role in treasury management, particularly in economies facing monetary instability.

ASX-Listed DigitalX Expands Bitcoin Treasury with $8.8M Purchase

DigitalX, Australia's sole ASX-listed crypto fund manager, has acquired 74.7 BTC for $8.8 million, averaging $117,293 per Bitcoin. This brings its total holdings to 499.8 BTC, valued at approximately $91.3 million. The firm now holds 306.8 BTC directly and 193 BTC through its stake in the DigitalX Bitcoin ETF.

The move underscores a growing trend among corporations to allocate treasury reserves to Bitcoin, following the lead of MicroStrategy. DigitalX's latest purchase follows a 57.5 BTC acquisition earlier this month, solidifying Bitcoin as the core of its treasury strategy.

MicroStrategy, under Michael Saylor's leadership, remains the largest corporate holder with over 597,000 BTC. Japanese firm Metaplanet has also recently joined the wave of companies embracing Bitcoin as a strategic asset.

AI vs BTC: Environmental Impact Comparison Sparks Debate

Mistral AI's disclosure of its flagship model's environmental footprint has ignited fresh comparisons with Bitcoin's energy consumption. The AI firm reported that training and operating its Mistral Large 2 model generated 20.4 kilotonnes of CO₂-equivalent emissions over 18 months, alongside significant water and mineral resource usage. A single 400-token chatbot response consumes just 1.14 grams of CO₂.

Bitcoin's proof-of-work mechanism, by contrast, emits 600-700 kilograms of CO₂ per transaction—alongside 17,000 liters of water and 130 grams of e-waste. The broader Bitcoin network's annual emissions reportedly dwarf AI's current footprint, reviving longstanding critiques of crypto mining's sustainability.

Bitcoin May Hit $131k If This Support Holds: What Lies Ahead for BTC Price?

Bitcoin's price trajectory suggests potential gains if key support levels hold, with Ali Martinez's analysis pointing to a bullish continuation. Trading between $116,000 and $121,000, BTC has shown resilience despite volatility, posting a 2.0% weekly gain and a 16.2% monthly increase.

Institutional interest is rising, with public companies now holding over 4% of Bitcoin's total supply. Prediction markets favor sustained bullish momentum through early August 2025, aligning with Martinez's Fibonacci-based technical analysis.

The 4-hour BTC/USDT chart on Binance highlights critical Fibonacci retracement levels, with the 0.786 level serving as a focal point for traders. This technical framework underscores the cryptocurrency's capacity for further upside.

PNC Bank Partners with Coinbase to Offer Crypto Trading Services

PNC Bank is set to launch cryptocurrency trading services for its wealth management clients through a strategic partnership with Coinbase. The collaboration will enable PNC customers to buy, sell, and hold digital assets like Bitcoin directly within their existing accounts, eliminating the need for third-party platforms.

The move underscores growing institutional demand for integrated crypto solutions. Emma Loftus, PNC’s head of treasury management, emphasized the bank’s focus on providing seamless access to digital assets while maintaining platform security. "This partnership allows us to explore where the market holds the most promise," she said.

Beyond trading, PNC plans to participate in an industry-led stablecoin network for payment settlements. In return, Coinbase will leverage PNC’s treasury and liquidity management services—a symbiotic relationship highlighting deepening ties between traditional finance and crypto infrastructure.

Bitcoin's $120K Threshold: Bulls and Bears in Tight Battle

Bitcoin's rally to a record $122,000 last week has given way to consolidation, with the cryptocurrency now testing critical support near $120,000. Myriad prediction markets reflect trader skepticism, pricing just a 47% chance of maintaining this psychological level by week's end.

Technical charts show BTC hovering at a descending trendline originating from its July 14 peak—a make-or-break juncture for short-term price action. The Squeeze Momentum Indicator suggests mounting pressure, though rapidly shifting market sentiment continues to rewrite the odds.

Hut 8 Secures Dubai License to Expand Bitcoin Strategy

Hut 8 Investment Ltd., a subsidiary of Nasdaq-listed Hut 8 Corp., has obtained a commercial license from the Dubai International Financial Centre (DIFC), marking a strategic expansion into one of the world's leading financial hubs. The license enables the firm to deploy its Bitcoin reserves into structured derivatives strategies, enhancing its active treasury management program.

The move follows Hut 8's reported $20 million in earnings from Bitcoin options strategies in 2024. By operating within the DIFC's internationally recognized regulatory framework, the company gains direct access to institutional markets and reduces trading costs associated with digital assets.

Dubai's progressive stance on cryptocurrency regulation continues to attract major industry players, with Hut 8 joining a growing list of firms leveraging the emirate's favorable ecosystem for blockchain-based financial activities.

SpaceX Moves $153M in Bitcoin After 3-Year Dormancy as Musk Faces Scrutiny

Elon Musk's aerospace company SpaceX has transferred 1,308 BTC ($153 million) to a consolidated wallet, marking its first Bitcoin transaction since June 2022. Blockchain tracker Arkham Intelligence revealed the movement from 16 addresses to a single SegWit-compatible wallet.

The private space firm maintains 8,285 BTC ($990 million) on its balance sheet according to bitcointreasuries.net data. This activity coincides with heightened scrutiny of Musk's enterprises following his public disputes with political figures.

SpaceX initially disclosed Bitcoin holdings in 2021, mirroring Musk's Tesla which currently holds $1.37 billion in cryptocurrency. The recent transfer follows SpaceX's 2022 transaction when it moved 3,500 BTC to Coinbase.

Figma Reveals $100M Bitcoin ETF Strategy Ahead of IPO

Figma has disclosed a $70 million position in Bitcoin ETFs through its SEC filings, signaling a cautious yet strategic entry into cryptocurrency markets. Unlike MicroStrategy's direct Bitcoin purchases, the design software firm is opting for regulated exposure via exchange-traded funds.

The company's IPO prospectus hints at broader crypto ambitions, including potential tokenization of stock through "Blockchain Common Stock." This move positions Figma at the intersection of traditional finance and Web3 innovation without the volatility risks of direct BTC ownership.

Market observers note the allocation could grow post-IPO, making Figma the first major design tools company to integrate cryptocurrency exposure into its corporate treasury strategy. The ETF approach reflects institutional preferences for regulated crypto products over direct asset custody.

Bitfarms Stock Surges 14% After Announcing $64M Share Buyback Plan

Bitfarms Ltd., the Toronto-based Bitcoin mining firm, saw its shares jump nearly 14% on NASDAQ following the announcement of a strategic share repurchase program. The company plans to buy back up to 49.9 million common shares—approximately 10% of its public float—representing about $64 million at current prices.

"Our Bitcoin operations remain undervalued by the market, with virtually no recognition given to our high-performance computing potential," said CEO Ben Gagnon. The buyback signals management's confidence in the company's dual focus on cryptocurrency mining and emerging AI applications.

The move comes three months after Bitfarms acquired Stronghold Digital Mining, marking its expansion into artificial intelligence infrastructure. Trading volumes spiked across both NASDAQ (BITF) and the Toronto Stock Exchange as investors responded to the capital allocation strategy.

SpaceX Moves $153 Million Worth of Bitcoin After 3 Years

SpaceX has transferred approximately $152.9 million in Bitcoin after a three-year dormancy, sparking speculation about its crypto strategy. The funds, totaling 1,308 BTC, were moved to a new wallet—bc1q8ka—suspected to be controlled by the company. Blockchain analytics platform Arkham Intelligence confirmed the transaction.

Contrary to initial fears of a sell-off, SpaceX retains 6,977 BTC in its Coinbase Prime custody wallet. The transfer appears to be a portfolio rebalancing move rather than liquidation. Market observers note such institutional reshuffling often precedes strategic positioning rather than bearish exits.

Elon Musk's aerospace company last made significant Bitcoin movements in 2021 when it reportedly liquidated portions of its holdings. The current activity suggests renewed institutional engagement with crypto assets, though SpaceX has not disclosed its intentions.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $131K | $150K | ETF inflows, halving aftermath |

| 2030 | $250K | $500K | Global regulatory clarity |

| 2035 | $750K | $1.2M | CBDC integration |

| 2040 | $1.5M | $3M+ | Scarcity-driven institutional FOMO |

William projects Bitcoin could reach $131K by late 2025 if it holds the current support level, with a potential 27% upside. Long-term, he anticipates exponential growth post-2030 as Bitcoin's fixed supply collides with increasing institutional and sovereign adoption. Key risks include regulatory shifts and technological disruptions.